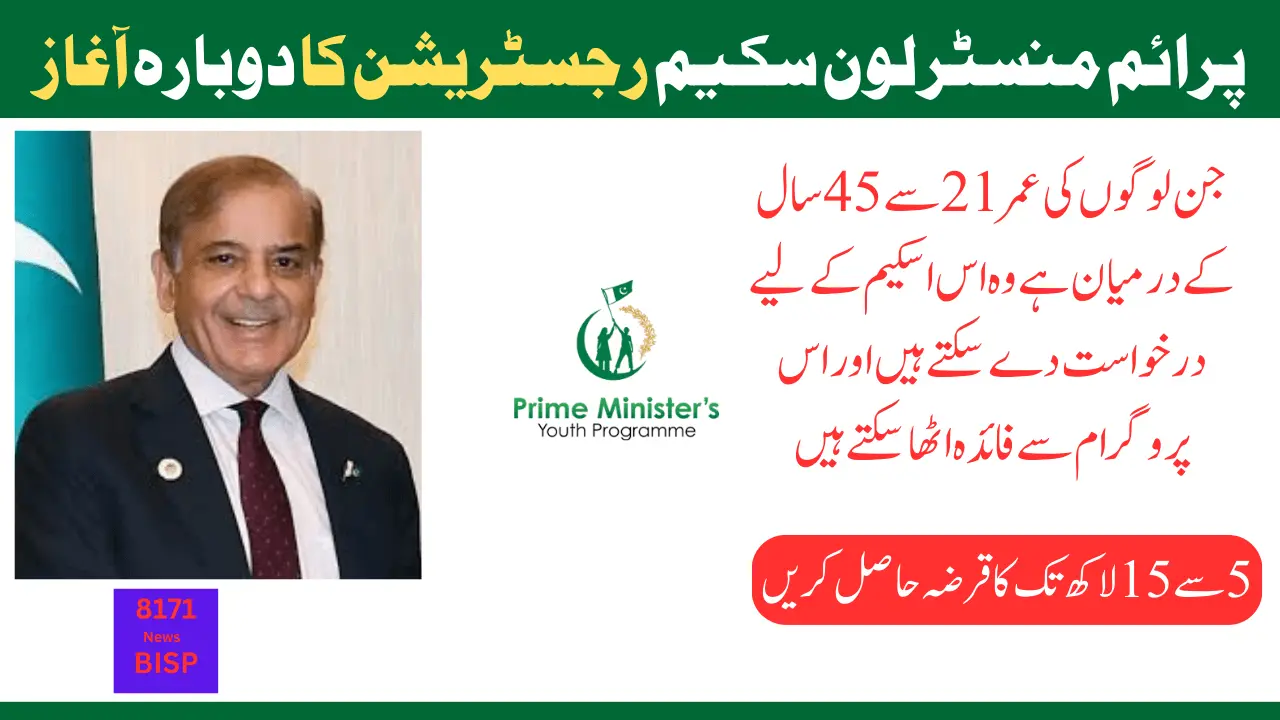

PM Youth Loan Scheme

PM Youth Loan Amount And Interest Rate

| Tiers No. | Loan Amount | Interest Rate |

| 1 | 1-5 lakh | 0% |

| 2 | 5 to 15 lakh | 5% |

| 3 | 15 to 75 lakh | 7% |

How To Apply Online For Loan?

If you want to register in the Pm youth loan scheme then you have read the article completely because the registration process is explained in this article. But you have to meet on the eligibility before registration. The eligibility criteria that set by the Govt is given below:

- A age limit of 21 years and an education minimum of Matric need for IT and e-commerce sector candidates.

- In the case of agricultural loans, the State Bank of Pakistan established terms and conditions for farmers will be applicable.

- Applicant must have the national CNIC that issued by the NADRA.

If we discuss about the registration procedure, when you visit the official website then you show a registration button. By clicking on it you can get a registration form.

Also Read:How to Apply for the Khidmat Card Program Latest Updates 2024

Required Document

If you want to get loan from the PM youth scheme, then you have to need the following documents.

- CNIC card

- Bank Account Details

- Matriculation certificate

Who are the people who cannot get a loan?

- The pakistanies who are live abroad they are ineligible for this scheme.

- If you have Govt Job,then you can not be able to get this loan.

- If the applicant does not have the identity card will be ineligible for this scheme.

- Those people who go to physically bank and complete the registration process can get this loan.

List of MFIs/MFBs For providing Tier 1

| S.No | Bank | MFIs/MFBs |

|---|---|---|

| 1 | National Bank of Pakistan | NRSP Microfinance Bank Rural Community Development Program (RCDP) |

| 2 | Bank of Punjab | Akhuwat Islamic Microfinance |

| 3 | Habib Bank Limited | Akhuwat Islamic Microfinance National Rural Support Program (NRSP) |

| 4 | Askari Bank | SAFCO Microfinance Company |

FAQ

Who is eligible for PMYB&als?

All Pakistani folk, whose aged between 21 and 45 years are eligible to apply for the loan

What is the time period for a PM youth loan?

The loanreturning period is about to

How can I check my eligibility for the PM loan scheme?

Eligibility Criteria

- Age: Between 21 Years 45 Years.

- Business type: Small and Medium Enterprises owned by youth as per above mentioned age brackets.

How do I check if I qualify for a loan?

Checking loan qualification

- Be prepared to provide proof of income. To qualify for most loans, you’ll need a stable job and regular income.

- Check your credit score.

- Assess your debt-to-income ratio (DTI).